Nvidia CEO, Jensen Huang, experienced a dramatic loss of $20 billion in one day, as the global tech market was shaken by the rise of a new Chinese-developed chatbot. This sudden downturn in Nvidia’s stock price highlights the volatile nature of the tech industry, where a single development can have enormous financial implications for even the largest companies.

The source of the shockwave was the announcement of a new artificial intelligence (AI) chatbot created in China that rivals the likes of OpenAI’s GPT models. The chatbot, which has quickly gained attention for its impressive capabilities, sent ripples of uncertainty throughout Silicon Valley. The rapid development of AI technology in China has the potential to disrupt the dominance of U.S. companies like Nvidia, which has long been a leader in the graphics processing unit (GPU) market, particularly for AI and machine learning applications.

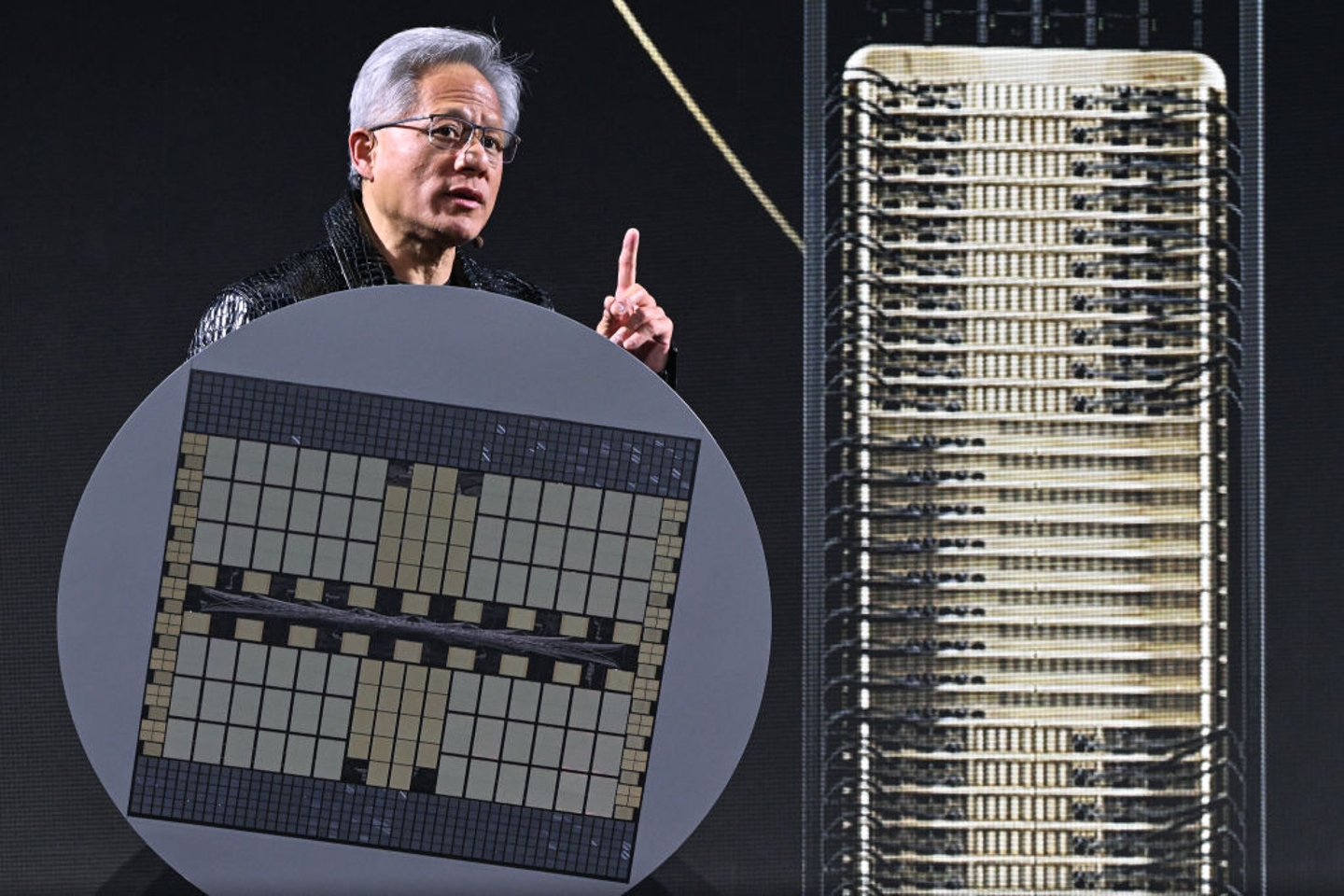

Nvidia’s GPUs are critical in powering AI systems and have become a cornerstone of the artificial intelligence revolution, which has fueled the company’s rapid growth in recent years. Huang, who co-founded Nvidia and has led the company through its most significant advancements, has seen his fortune tied closely to the performance of Nvidia’s stock. However, the rise of a competitive Chinese chatbot has raised questions about the future of AI development and the global race for dominance in this field.

The Chinese chatbot’s ability to rival its Western counterparts has spooked investors. Analysts are concerned that this new technology could lead to a shift in AI development, potentially reducing demand for Nvidia’s products. Many of Nvidia’s GPUs are specifically designed for tasks like training and running AI models, and if China’s AI innovations continue to grow, it could create a shift in the market that reduces the reliance on Western technologies, including Nvidia’s offerings.

The loss of $20 billion in a single day was a stark reminder of how quickly fortunes can change in the tech world. Investors, who had already been cautious about the competitive nature of the AI market, reacted swiftly, sending Nvidia’s stock into a sharp decline. The scale of the drop was unprecedented, as Nvidia had been seen as one of the most valuable tech companies, particularly due to its positioning in the AI sector.

In response to the sudden market turbulence, Huang and other Nvidia executives have been working to reassure investors. They have emphasized Nvidia’s continued leadership in GPU technology, which is not only used for AI but also for gaming, data centers, and other high-performance computing applications. While the emergence of the Chinese chatbot may present new challenges, Nvidia’s executives argue that the company is well-positioned to adapt and continue driving innovation in AI and other sectors.

Despite these reassurances, the impact of the Chinese chatbot on Nvidia’s stock highlights the intense competition within the AI space and the growing importance of geopolitical factors in shaping the future of technology. As China continues to make significant strides in AI and other emerging technologies, the global tech landscape could become increasingly competitive, with companies like Nvidia facing new challenges from unexpected sources.

The dramatic loss suffered by Huang and Nvidia underscores the fragility of tech company valuations and the global stakes of the AI race. As the chatbot wars unfold, Nvidia’s ability to maintain its leadership position and adapt to changing market dynamics will be critical in determining its future success. Investors will be closely monitoring how the company responds to these new developments and whether it can continue to thrive amid growing competition from China and other global players in the tech space.